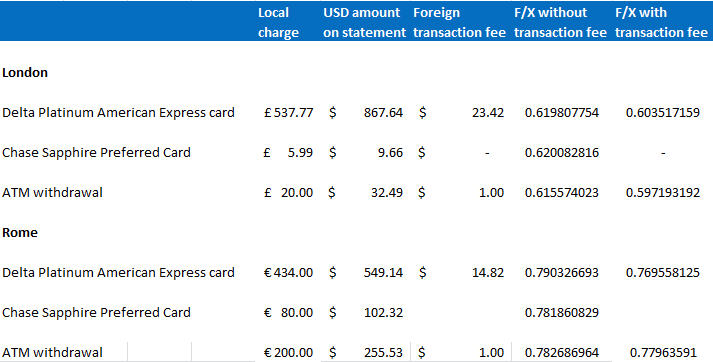

There have been quite a few credit cards lately that are touting “no foreign transaction fees†– the up to 3% charge you usually get from your credit card for using your credit card overseas. Call me a cynic, but I’ve always questioned whether no foreign transaction fee cards were making their money back by perhaps giving you a worse exchange rate than foreign transaction fee cards and adding in some other hidden things. I finally decided to put it to the test and took my Delta Platinum American Express card with foreign transaction fees, my Chase Sapphire Preferred card with no transaction fees, and my debit card for ATM withdrawals to the test on a recent overseas trip.

I made charges in London and in Rome at several merchants and withdrew money to test what the actual rate charged was with and without the foreign transaction fee. I made sure to make these charges on the same day so that it wouldn’t skew the results. Here are my findings:

Surprising to the skeptic in me, there was no noticeable difference in the exchange rates between the foreign transaction card, the non-foreign transaction card, and the debit card.

Therefore the decision of what card to use then comes down to how much you’re willing to pay for the miles / points on a foreign transaction fee card. For me – the decision is easy as I live in a Delta hub city. I always use my American Express card even with the foreign transactions fees. However, I may look to change this strategy as I’ve finally proven to myself that there is no chicanery with no foreign transaction fee cards.

Several of the commenters are missing the significance of the post. His conclusion was that there was no chicanery going on, i.e., you are getting the same exchange rate before the fee is levied, so there is a real savings to using a non-forex fee card.

By law they are required to give you the real rate. About 10 years ago there was a massive Class Action suit. That’s when the banks started adding on “FOREX” charges, as they could no longere rip people off on the rate

@Nancy: Except that the data seems to indicate that there *ISN’T* a systematic bundling into the exchange rate.

@Yana K: I don’t really care what the precise wholesale rate is if I cannot get that rate at a retail transaction level. If my foreign transaction fee rate is fairly consistently 1.0% worse than the wholesale rate, but the card that indicates it charges 3% is in fact another 3% worse than that, then the foreign transaction free card issuer is advertising honestly.

You see “no noticeable difference in the exchange rates” because 3% is a not a very noticeable amount to begin with. I agree with Peter Johnson’s analysis – the no foreign transaction fee card DOES save your money, although the amount varies based on the currency and specific card.

While there is no free lunch (i.e. there is no such thing as no markup on a wholesale rate), the truth is somewhere in between – no foreign transaction fee exchange rate is better than a typical card but worse off then the wholesale rate.

I use the Fidelity Cash ATM card, no fees on all ATM withdrawals.

nerdwallet had more or less the same finding when they ran a pretty detailed analysis a few years ago:

http://www.nerdwallet.com/blog/top-credit-cards/no-foreign-transaction-fee-credit-card/

@mg – good to know – never heard of nerdwallet before

using Delta Platinum: £537.77/0.603517159 = $891.06

using Chase Sapphire: £537.77/0.620082816 = $867.26

using ATM withdrawal: £537.77/0.597193192 = $900.50

So if you used the Sapphire card instead of the Delta Platinum, you saved $23.80 or 2.7%.

using Delta Platinum: £434.00/0.769558125 = $563.96

using Chase Sapphire: £434.00/0.781860829 = $555.09

using ATM withdrawal: £434.00/0.77963591 = $556.67

So if you used the Sapphire card instead of the Delta Platinum, you saved $8.87 or 1.6%.

Here in Brazil all the credit cards have foreign transaction fees. A fixed rate of 6,38% of each purchase. 🙁

Thank you for posting! This has always annoyed me about the other bloggers who are always going on about the “No foreign transaction fee” credit cards. Sure it’s not a separate line item like AMEX but they build the “fee” into the exchange rate. Use the card that makes the most sense for your travel/points/spending needs.

Thanks for posting this analysis, Jason. I travel quite a bit internationally and, like you, was always skeptical. That said, I only use non foreign transaction charge cards, in case. Now I feel good about resigning my Amex card to the desk drawer. Thanks again.

@levy flight – thanks!

Hmm…really interesting.

I did this a few years ago with my Fidelity Rewards FIA issued Amex and Capital One in Japan and there was only the 1% difference due to FIA’s 1% foreign transaction fee. Both rates were also in line with the wholesale rate at xe.com.

@askmrlee – thanks for posting your results!

I’ve noticed that with my Sapphire Preferred Card. I get the same exchange rate in Korea as I get out of the ATM’s and money changers on the US military bases.

@jeff – thanks for posting your experience